This article was originally published by Intelligent Transport.

App-based ride-hailing comes in all forms and sizes; you can ask for a luxury vehicle to pick you up as you leave your London office, call a two- or three‑wheeler to your housing complex in New Delhi or Jakarta, or use a dedicated app to order safe rides for your children in California. On‑demand rides are just a screen touch away in cities across the world.

In recent months, the ride-hailing market has suffered a significant decline, mainly due to the consequences of COVID-19. The global ride-hailing market is expected to decline from $60.5 billion in 2019 to $52.07 billion in 2020 at a compound annual growth rate (CAGR) of -14 per cent. Despite, the COVID-19 induced setback, the market is expected to recover swiftly and reach $85.5 billion in 2023 at a CAGR of 18 per cent.

The continued growth of the ride-hailing industry can make mobility convenient, affordable and accessible – but it can also result in increased carbon emissions and pollution.

Showcasing the negative environmental impacts of current ride-hailing services, a recent report by the Union of Concerned Scientists called on ride-hailing companies to electrify their fleets, increase the share of pooled rides and improve connections to public transit hubs. According to their report, an electric, non-pooled ride-hailing trip can cut emissions by about 53 per cent. Another recent study showcases how replacing ride-hailing cars with electric vehicles (EVs) would deliver three times the environmental benefits and emission reductions compared to replacing regular private vehicles. The good news is, on a total cost of ownership (TCO) basis, electric ride-hailing is possible and economically viable today in most large global cities and across different vehicle formats (micromobility scooters and two-, three- and four-wheelers). Even though EVs are still more expensive to buy than their combustion engine counterparts, they are usually cheaper to run; the more an electric vehicle is utilised, the lower its TCO. With a higher vehicle utilisation than most other use-cases, ride-hailing fleets are ideal for an early EV transition. Over the next five to seven years, as EVs become cheaper to buy, combustion vehicles may no longer be able to compete with EVs for ride-hailing.

Current commitments

Recognising this transition, Uber recently committed to become a fully zero-emission platform by 2040 and has set an earlier goal to have 100 per cent of rides take place in EVs in U.S., Canadian and European cities by 2030. Similarly, Lyft has committed to a 100 per cent electric fleet by 2030. China’s Didi Chuxing, in 2018, announced that it is aiming to bring 10 million EVs on its platform by 2028. India’s Ola has also announced its ‘Mission Electric’ – an initiative to add millions of vehicles (with a focus on two- and three-wheeler EV) across its platform.

Companies are also stepping up their efforts through collaborative action. For example, China’s Didi Chuxing has partnered with BYD to co-design custom EVs for ride-hailing and has set up a joint venture with BP to set up charging infrastructure. Uber has committed $800 million in resources to support drivers to switch to electric and has also initiated several partnerships with vehicle manufacturers and charging infrastructure companies in different geographies.

Local and national governments are keen to support this transition as well. Globally, 13 countries and 31 cities have declared plans for phasing out sales of internal combustion vehicles. Many other cities are planning for zero-emission zones; in 2019, the Chinese city of Shenzhen issued specific guidelines requiring all new vehicles registered for app-based ride-hailing services to be fully electric.

Moving forward

This transition needs to be accelerated across ride-hailing platforms and geographies. In India, the World Business Council for Sustainable Development supported and documented learnings from a demonstration project for an all-electric ride-hailing platform called BluSmart. Launched in 2019 in New Delhi as India’s first all-electric car ride-hailing company, BluSmart has since completed five million clean kilometres with a fleet of 300 cars. The start-up claims to achieve 35‑40 per cent lower TCO as compared to combustion vehicles on competing ride-hailing platforms.

Ride-hailing cars represent 1.2 per cent of the total car stock in India (as of 2019) but contribute to six per cent of the total emissions caused by cars. A 100 per cent adoption of electric ride-hailing cars in India by 2030 equates to a reduction of 12 million tons of CO2 emissions per year, avoiding consumption of 11 billion litres of fuel in a year.

The BluSmart case has proved that despite all the constraints on vehicle availability and range – and limited to no public changing infrastructure – improved vehicle utilisation by optimising driver‑car ratio and reduced dry-run through charging placement interventions can help make EV deployment viable for ride-hailing today.

While the BluSmart demonstration project showcases the viability of all-electric ride-hailing in a nascent market; large global and regional ride-hailing platforms have the scale and capability to work with local governments, driver-partners, vehicle manufacturers and charge point operators to solve some of the bigger challenges for faster electrification of vehicles in our cities.

Even as large platforms strategically move their pieces on the EV ride-hailing chess board, all-electric ride-hailing services are cropping up in various geographies: BluSmart in India, ZEV in Taiwan, Current Taxi and Go360 in the US, and Volkswagen’s MOIA in Germany are just a handful of examples.

The scale up

Established ride-hailing companies have the scale, data and technological know-how to accelerate electrification for all other use cases. Their early adoption can bring the required scale to support mass manufacturing for fit-for-purpose vehicles.

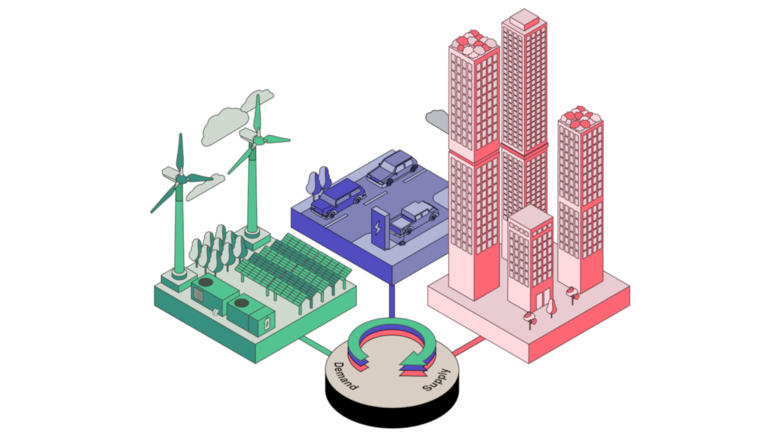

Ride-hailing platforms can use their mobility data to support the creation of a tailored charging infrastructure and can become a constructive partner to cities and utilities to help re-design elements of the built environment. Ride-hailing platforms can also provide other societal services. At their scale, large ride‑hailing fleets can provide grid management services to cities – potentially opening additional revenue sources for driver partners. In nascent markets, electrified ride-hailing fleets can provide guaranteed demand to charge point operators, supporting early public infrastructure development.

Given the business case for electrification of ride-hailing, billions of annual ride-hailing trips will need to be electrified in a relatively short duration of time. To put things in perspective, the share of all‑electric rides on most major platforms is currently estimated to be less than one per cent of their total rides. This is a challenging task and the future of our cities and planet is at stake.

Electrification of ride-hailing and transport in general is one of many important actions that the world needs to take in order to reach the goals of the Paris Agreement. To support businesses in this transition, WBCSD has developed an online corporate EV adoption guide with clear steps for planning and adopting an electric fleet.

For this transition to be fully realised, collaboration across sectors with policy makers, driver-partners, vehicle manufacturers, utilities, charge point operators and customers is crucial.

WBCSD’s Transforming Urban Mobility project brings businesses and cities together to implement system‑level and integrated initiatives to steer urban mobility systems transformation towards a safer, cleaner, more accessible, and more efficient future. We believe that ride-hailing platforms can, and will, lead the global EV transition and are happy to support them on the journey to make urban mobility sustainable.